In the fortnight since commerce and industry minister at the Startup Mahakumbh, we have seen a range of comments, rants, potshots and some hot takes — everyone has an opinion on why the Indian startup ecosystem has not cracked the deeptech code.

Before going deeper into the issue — what exactly is deeptech and why is it such a hot topic right now after all?

There is no hard definition for deeptech, and this is perhaps why it’s been so poorly written about in recent days. But we will try to break it down.

As far as Inc42’s thesis is concerned, deeptech governs areas that are considered pure-play tech — the stuff that becomes intellectual property (IP) aka the building blocks for the tech industry at large. But the definition varies depending on who you speak to.

A lot of new-age tech is crammed under the deeptech umbrella — from foundational models to proprietary artificial intelligence and machine learning algorithms, to original IP creation in robotics, industrial systems, electronics systems and chip design, green energy and climate tech solutions, healthcare systems, aerospace (drones and spacecraft), connected and autonomous vehicles, and everything that can be clubbed together as futuristic.

Some call it frontier tech, others deeptech and many others simply AI.

Indeed, within the sprawling landscape of deeptech, the incredible rise of generative AI and consequently the fortunes of model makers such as OpenAI and Google have sharpened the focus on AI and GenAI models. And it is arguably this gold mine that India is missing out on right now. In many ways, AI models will shape the various other segments within deeptech.

So India needs its own GPT or Gemini goes the cry. And that’s where we are today with the whole debate on sovereign models.

Deeptech In A Nation Of ConsumersOne doesn’t need to think too long to know that Indian startups are perhaps not the frontrunners in the deeptech innovation race. Instead, as Goyal lamented, the focus has been on building businesses that are adjacent to retail business models — dukaandari or running a shop, as the minister phrased it.

Let’s not talk about specific companies here, but the largest Indian startups by valuation and market cap are not companies that have created the fundamental pieces of the internet ecosystem, but those that have leveraged internet access to offer services through apps and software products. In many cases, they were simply clones of Silicon Valley startups that set the trend.

No one can fault founders for looking for large outcomes in the consumer market — India is after all the most populous country in the world, and that means the most number of consumers in any one country. If good business means solving big problems, then consumer startups definitely targetted the largest audience base.

Nothing wrong with that approach, and not everyone can be expected to build the next AWS or Google or Nvidia or OpenAI, some do need to build a Zomato or Flipkart or Swiggy to sell to the masses. The other part of the complaint around copycat or clone startups is somewhat more valid.

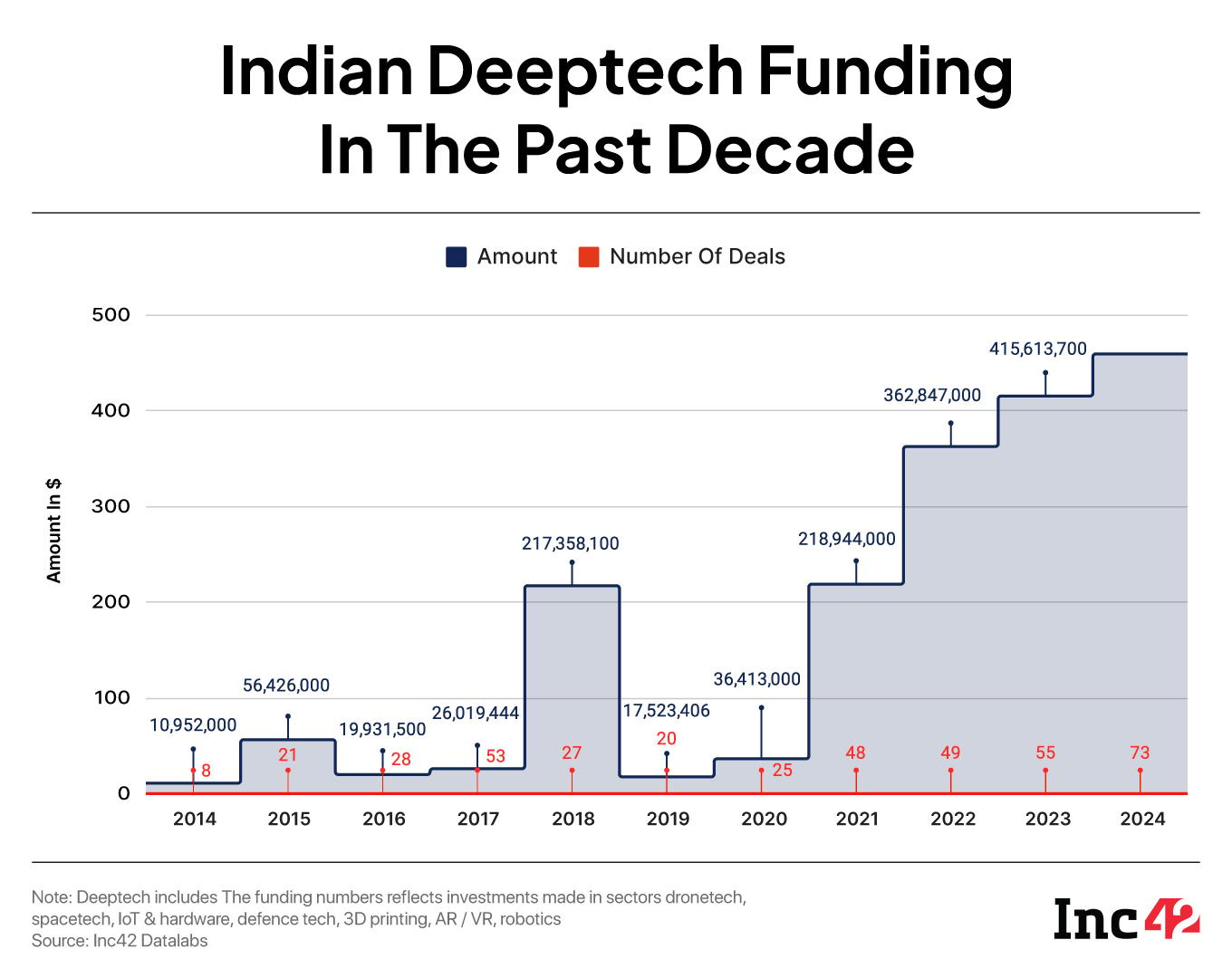

Having said that, it’s not like deeptech is dead in India — it’s been slow to take off unlike and too timid compared to other sectors. And it’s worth examining why and what needs to change to fix that.

We can debate endlessly on whether Goyal’s description is perhaps a bit unfair on some Indian startups that have become global examples in this very dukaandari. But we cannot say that he was completely wrong either.

Amid all this, there’s a whole lot of finger-pointing and blame games going around. But time to go beyond that and see where India truly stands.

A short aside: The timing of Goyal’s remarks cannot be overlooked. It coincided with sweeping changes in the US with regards to GPU exports and a tariff-led trade battle with China and other nations. Naturally, this created a sense that the world of AI was going to be split according to geopolitical alliances and territorial maps.

Goyal made a number of visits to the US earlier this year to discuss the tariff situation, and it seems that it is largely in this context that the issue of India’s deeptech capability has taken on a greater significance.

A bilateral trade agreement has been proposed by India, but at the moment, this is not close to fruition. In the event that such a trade agreement is not struck, India would be very much left on its own when it comes to AI. And hence the talk of sovereign AI.

But, what even is sovereign AI?

Sovereign Or Global? The Trillion Dollar QuestionIt sounds incongruous — sovereign being a term of French origin from the early 14th century and AI of course being quintessentially 20th century — but there’s a reason this has become en vogue.

“If you had asked me just six months ago, I would have said there’s no need for India to develop a ‘sovereign model’, but a lot has changed in that time. And now I definitely believe that we need to take control of our destiny,” Ashwin Raguraman, founder of Bharat Innovation Fund, told Inc42 on the sidelines of The GenAI Summit in Bengaluru last week.

In many ways, this was the theme of the summit, with pretty much every panel discussion and keynote highlighting the need for a homebrewed revolution in Indian AI.

From the geopolitical shifts of the past six months, DeepSeek’s disruption to Silicon Valley’s AI giants and the very real possibility of a fragmented AI world, many in the Indian startup ecosystem are finally speaking about sovereign models for the first time.

But for others like Sarvam AI founder Vivek Raghavan, a sovereign model is at the very root of what they are doing.

“We always wanted to think of the concept of sovereign AI. This can mean a lot of things. It’s not necessarily country-sovereign; it can also be sovereign to enterprises. Either way, the question is how do you control your own data, your own models and your own compute, to actually serve something, rather than your key IP or data going away,” Raghavan said during a fireside chat at The GenAI Summit.

For Raghavan and Sarvam, sovereignty is core to the idea of building foundational models. The founder believes India needs to build a sovereign model because generative AI is clearly a transformative technology which is going to impact every industry and people in every way.

“It’s important that there are players who understand this from the foundational level. If you don’t do that, there’s a major risk — this is already a geopolitical game so access to certain technologies could potentially be restricted in the future.”

So those are the key pieces of the sovereign AI puzzle. And where does India stand when it comes to the talent needed to pull this off? And what role does private investment have to play in allowing India to create these pillars?

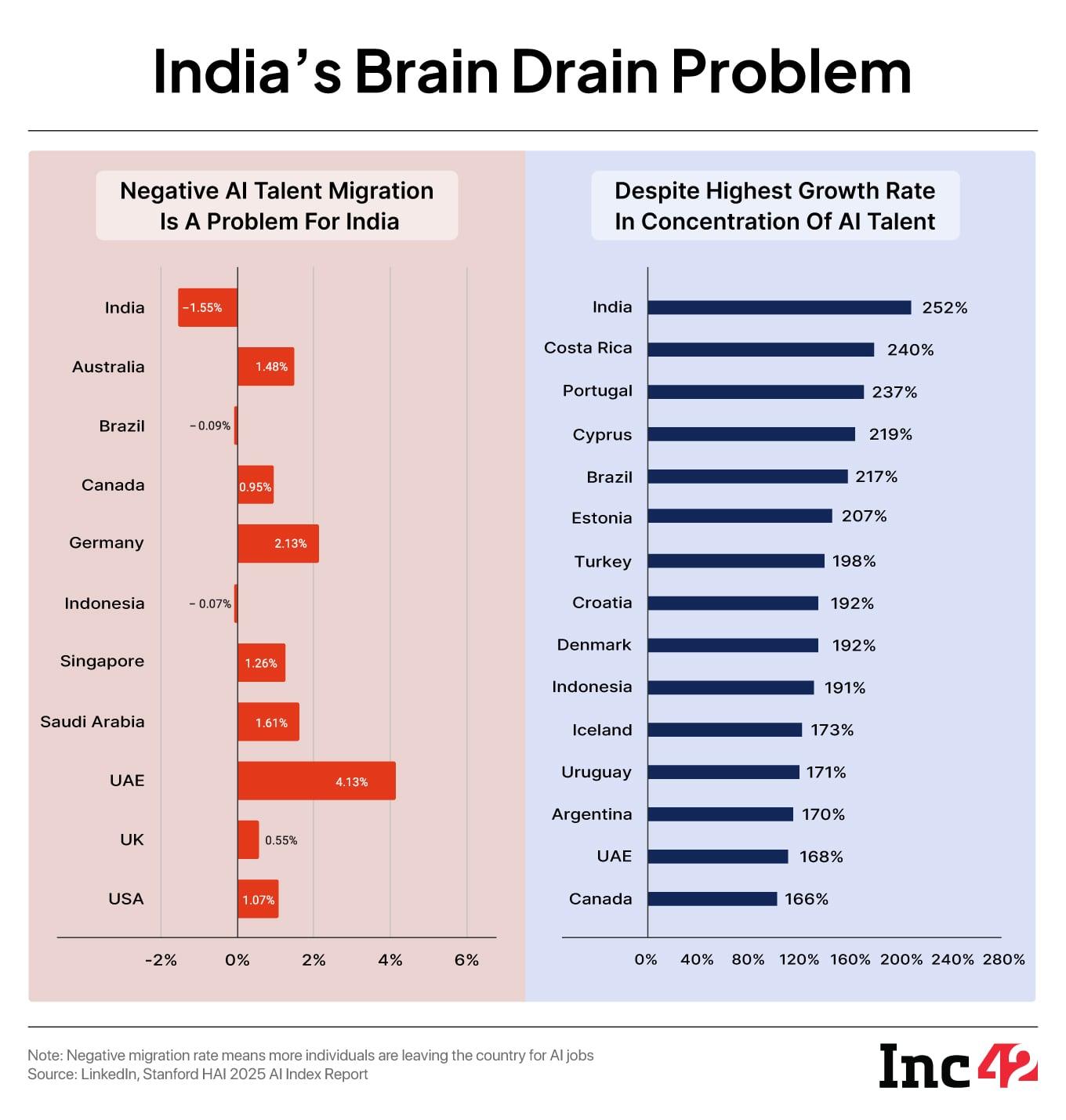

Does India Have The Talent?The perception of talent being limited in India is another reason cited often for the lack of deeptech innovation from the country. But according to Stanford University’s , AI talent concentration has shown the highest increase in India among several major economies since 2016.

With a 252% increase in AI talent in the past nine years, India was leagues ahead of the likes of Portugal, Brazil, Turkey, Indonesia and other comparable economies. The problem may lie in talent migration from India.

The same Stanford report shows that India has a rate of -1.55% for talent migration, indicating that more talent is departing India than coming into the country. This migration rate has remained in the negative since 2020.

In comparison, the UAE has a talent migration rate of 4.13% and even the USA has a migration rate of 1%, showing that more talent is coming into these countries for AI work than going out.

India’s stature as the third-largest startup ecosystem in the world does not seem to hold sway when it comes to retaining talent. And migration of talent is one issue that Raghavan pointed out.

“If you look at the people who are building foundational models around the world, Indians are a significant portion of their teams. There’s nothing fundamentally lacking in talent for India. What Indian talent lacks are the experience and the tricks needed to do some of these things and that experience can come from organisations too,” he added.

In July 2023, a draft version of the National Deep Tech Startup Policy by the central government’s Principal Scientific Adviser one potential solution to the brain drain issue, claiming that it can be tackled by “creating incentives to retain these professionals (a) skill enhancement grants that cover the cost of training and upskilling for employees in deep tech startups (b) grant matching programs that match a portion of the salary offered by startups to qualified professionals to help bridge the salary gap.”

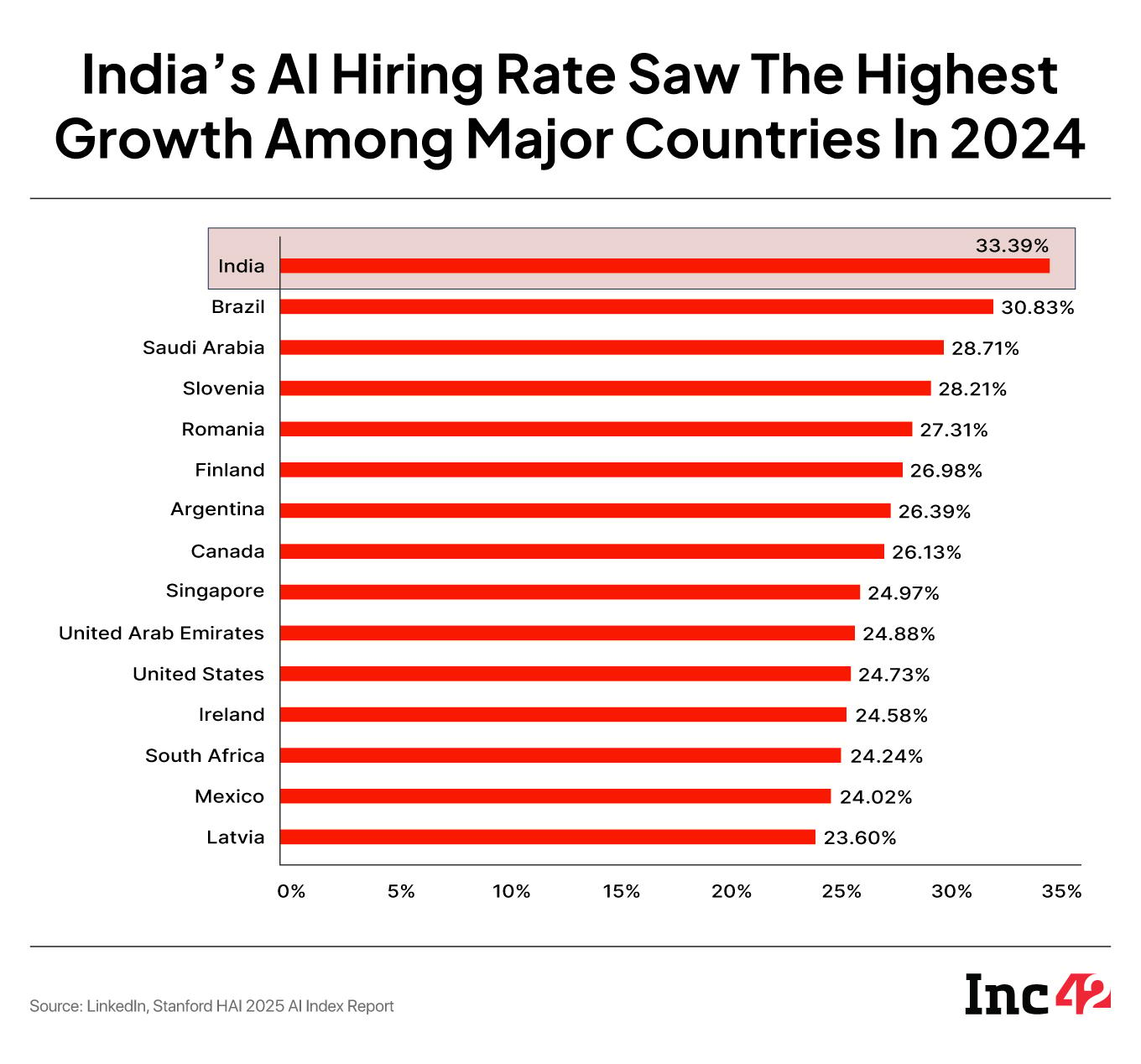

However, Indian companies are also adding more AI jobs than most other developing or developed nations.

In 2024, for instance, the Stanford AI report claims India had the greatest relative YoY AI hiring rates at 33.4%, followed by Brazil (30.8%) and Saudi Arabia (28.7%). This essentially means the ratio of AI talent hiring relative to overall hiring grew by 33.4% in comparison to 2023.

So while AI hiring is growing, the brain drain means the pool of AI talent is shrinking. This indicates a potential problem of tight competition for talent in the medium term.

For nearly two years, this draft bill has been in cold storage and unsurprisingly, brain drain is a problem that has only been exacerbated by the lopsided investments in AI in the US and China and the higher engagement by governments in these countries with AI startups — as we will see.

Citing the example of DeepSeek and China, Sarvam’s Raghavan and Bharat Innovation Fund’s Raghuraman also said talent in most AI-first countries has the luxury of time and an ecosystem that allows them to pull off the innovation at a low cost or groundbreaking innovations. Simply put, India needs the ecosystem to build this playbook.

And What About The Capital?Here, once again we are coming back to data from the 2025 AI Index report.

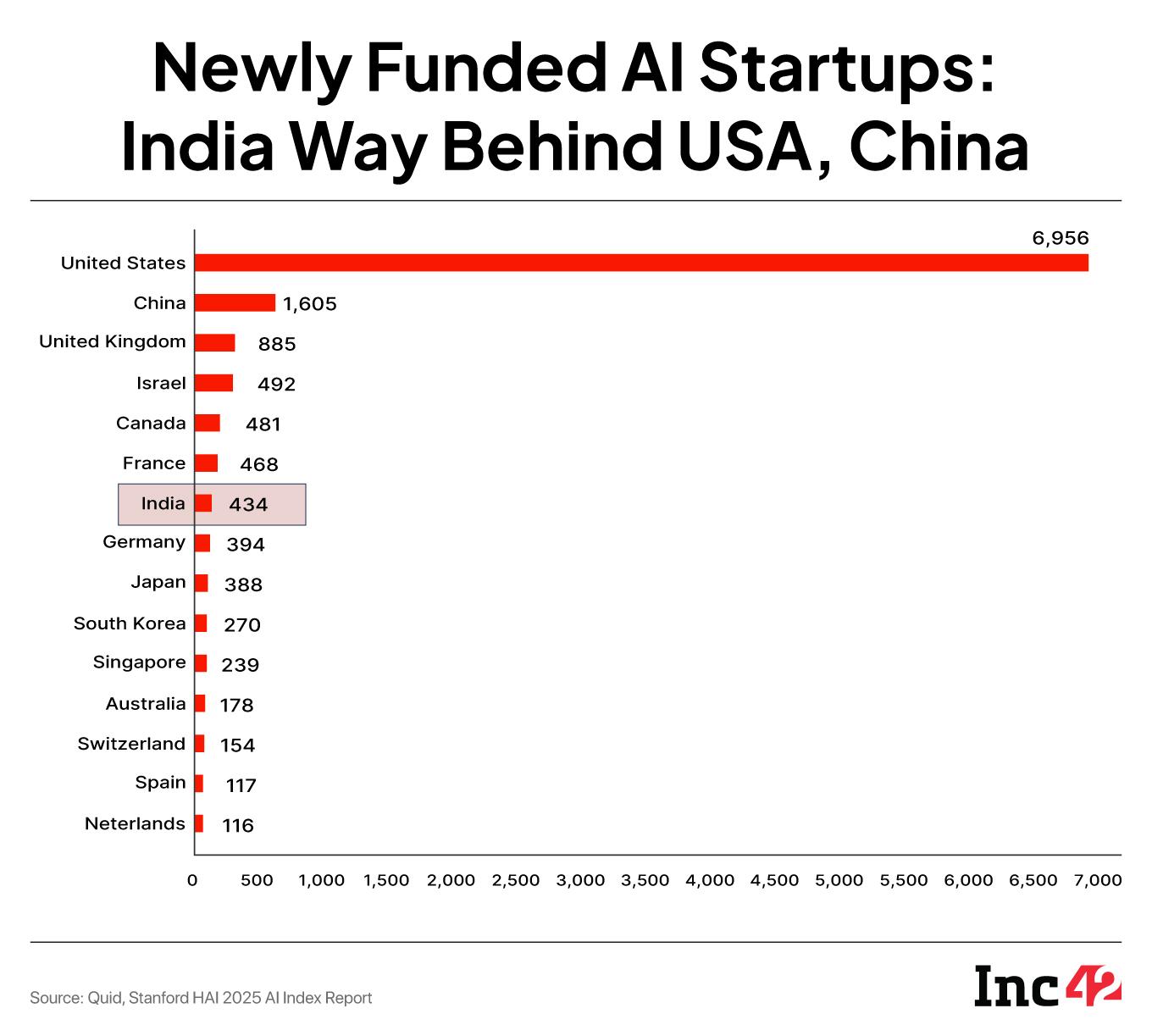

In 2024, a staggering $109.1 Bn was invested in the United States in AI startups and companies. That’s 11.7x greater than the amount invested in China ($9.3 Bn) and a whopping 100x the amount invested in India ($1.16 Bn).

Over a period of 11 years (2013-2024), US-based AI companies raised 41X the amount raised by Indian startups.

The numbers get even worse when you look at newly funded AI startups. The United States leads all surveyed countries with 1,073 new AI companies in 2024, whereas India has a relatively paltry 74 in comparison. Over the course of 11 years, the US saw nearly 7,000 newly funded AI companies, compared to around 430 for India.

And these are figures only for AI — investments in other areas of deeptech are likely to show India in a similar shade.

These numbers show that even as the AI revolution has caught up speed and attracted government, investor and founder attention in India, the gulf in private investments in the US and in India has only widened. So are Indian founders and indeed, the government right in bemoaning the lack of enthusiasm by investors in India?

Labelling deeptech as ‘Frontier Tech’, a recent 3one4 Capital report claimed, “Breakthrough technologies often face the challenge of translating scientific ingenuity into commercially viable business models. Many Frontier Tech ventures struggle with early monetisation, making it critical to align technological breakthroughs with viable market demand. Our experience has shown that companies that embed commercial thinking early in their R&D cycles are better positioned to scale.”

There’s of course a lot of merit to this notion. And it’s also why many deeptech startups get stuck in the early stage of funding and aren’t able to raise intermediate rounds. They are left with little funds for R&D and commercialisation, and cannot move forward on either front.

However, this balanced approach is simply not possible in many cases where the R&D cycle itself is long and winding. Take for instance, the problem of compute and hardware needed to run AI models — balancing R&D with commercialisation in this area will take decades and billions in many cases.

For context, Shashwath T R, cofounder and CEO of fabless semiconductor startup Mindgrove Technologies, told Inc42 that setting up a single OSAT plant takes $500 Mn or more. And that’s just for an OSAT or outsourced semiconductor assembly and testing, where other chipmakers can assemble, package and test their products. A fabrication unit or foundry requires magnitudes more.

A real example is Kaynes Technologies, a four-decade-old listed integrated electronics manufacturer, which in 2023, and is , with an allocation of over $600 Mn. Startups do not often have access to such capital — at least not in deeptech.

Some might say that Zepto raised nearly twice that in 2024, so why not put half of that in a deeptech startup? Most VCs you speak to today would dismiss that as a simplistic view:

“Investors do not know which way the needle will move in hardware and deeptech. Something big today could become irrelevant tomorrow. Who is going to take the bet that the founder will be capable of pivoting in a hardware venture or in a robotics startup? And are any founders even capable of such shifts? These are questions that Indian VCs ask themselves on a daily basis,” says one Bengaluru-based deeptech VC.

This fund manager added that no one in India knows whether a startup can even make the next great chipset for AI. All logic suggests this game will be won by the big tech giants. The question that remains unsaid is: How can investors be asked to risk their money on something which has such a low success rate?

When Will Policymakers Plug The Gap?So who else needs to share that risk? Many investors believe that the government needs to walk the talk i.e. put sovereign funds behind this push for sovereign AI.

And this requires a drastic shift in government spending for AI and even how the existing mechanisms such as the Fund Of Funds For Startups or other government funds are allocated.

Most recently, there have been plans to launch a deeptech-specific fund of funds which would invest in AIFs that then back startups, with a planned allocation of up to INR 20,000 Cr. Besides this, there are umpteen government and parastatal bodies that offer grants for deeptech R&D in the grassroots or university level.

In the wake of Goyal’s remarks at the Startup Mahakumbh, a number of entrepreneurs have challenged the notion that the government has supported deeptech startups, with complaints about the lack of government engagement for deeptech products, poor support for participation in tenders and more. Many have also bemoaned the fact that so far funds allocated to AIFs have been infused in the very same startups that Goyal said India has to move beyond.

In this case, the unsaid question was: Who exactly was Goyal’s message for? Government-backed AIFs have not painted themselves in a glowing light when it comes to deeptech. So the lack of a deeptech ethic in India is not just a responsibility of founders.

Then there is the question of the government itself leveraging deeptech solutions or formulating clear policies for applications of frontier tech.

The Stanford report states the United States was the leading nation, with about $5.2 Bn distributed across 2,678 unique AI contracts tendered by the government bodies. India does not make the top 15 in this metric or any related metric around government-led AI contracts with private companies, even though the report did study government contracts from India.

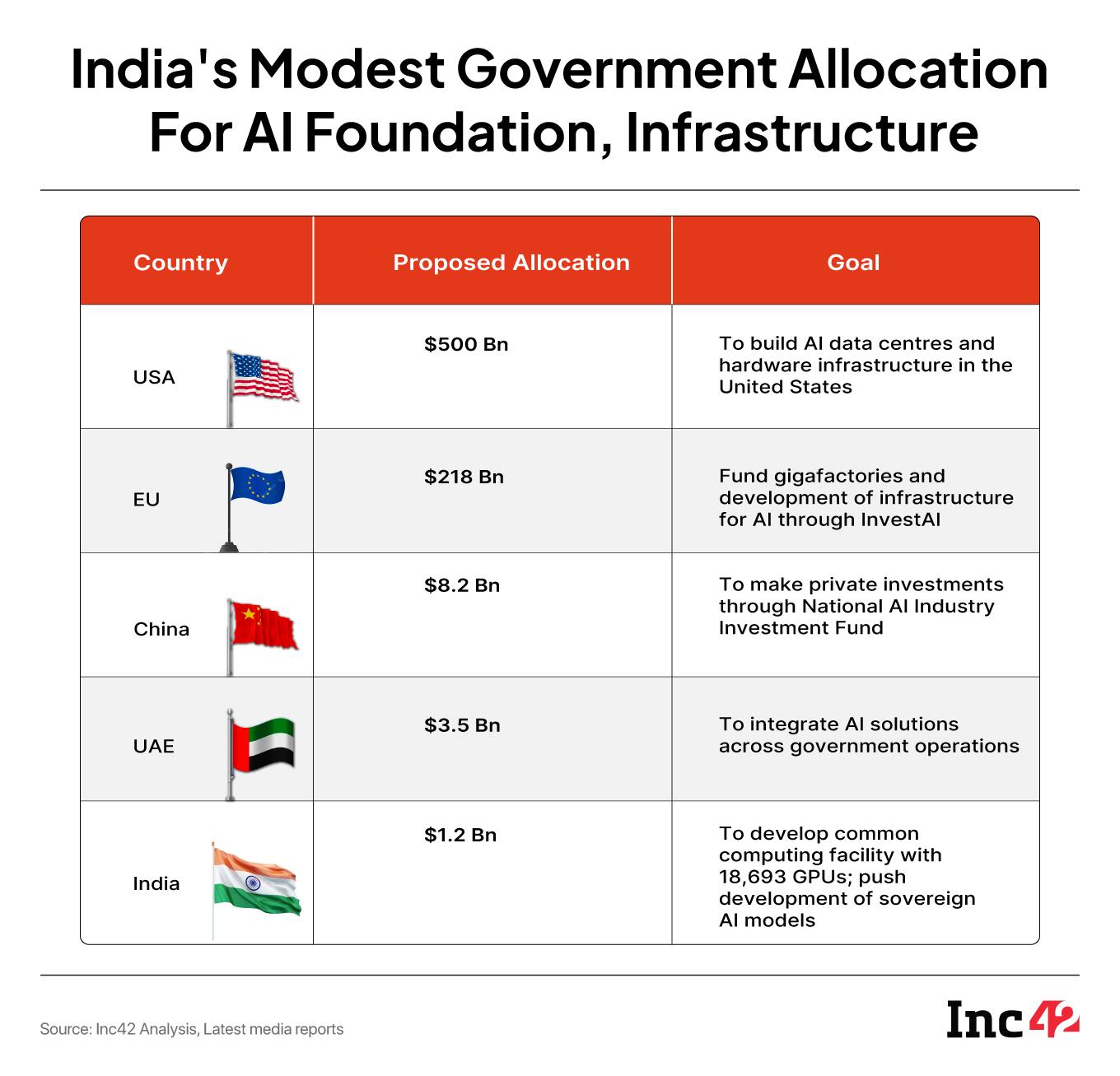

In the US, the Stargate project, involving a $500 Bn public-private partnership, has caught the eye. China established a $8.2 Bn National AI Industry Investment Fund to boost the country’s AI capabilities. On the other hand, the Indian government approved the IndiaAI Mission with a budget of a comparatively meagre INR 10,372 Cr ($1.2 Bn) fund for investments to be made over five years.

Given the size of the job at hand, many say this is not enough to create the sovereign AI that India needs right now.

Is Truly Sovereign AI Even Possible?In many ways, these various pillars of AI — the talent and founder depth, the government support and the role of investors — are interdependent. One cannot hope to develop the deeptech playbook for India in isolation.

And even when they are in sync, a truly sovereign AI may just be the stuff of dreams for most of us for the next decade or so. Most models are dependent on GPUs or high-end CPUs that are not made in India or even in China in some cases. The USA has an inherent advantage in this regard as well.

“The next 25 years — the tariff wars and geopolitical tensions — will go through the roof. So it’s very critical in this unstable time to cohesively come together and figure out the India playbook, especially for AI. And there’s merit in looking at how China did it; some of that is applicable for India,” Umakant Soni, chairman at AI Foundry, cofounder of ARTPARK and deeptech fund pi Ventures.

DeepSeek built on top of something that existed, but has become China’s trump card in the AI wars and is being used in infrastructure projects and by automobile makers, Soni added.

“India has so many issues to be solved from healthcare, education, mobility and we have a wealth of data around these problems. So maybe our focus or playbook should be around universal basic intelligence or UBI, which can be our edge or our sovereign AI model,” Soni told Inc42.

The Indian ecosystem finds itself way further and further behind market leaders especially as we go further upstream in the value chain of AI and deeptech. So approaching this from a post-AI point of view might be the right approach, instead of focussing on building the foundations.

With data and talent we have two unlockers at the more surface level, but building the infrastructure and foundation will require India to swallow a bitter pill. That bitter pill is that some of that talent will dissipate in the interim and the advantage in terms of data is not permanent.

Soni’s belief is that the world needs a leader to help transition people into the age of intelligence or the AI economy. But to do that we need robust policy to go along with homegrown LLMs and a strategy around using the AI revolution to create more jobs. Of course, the work for local language and India-focussed models will have to continue in sync with this push.

Reliance Jio’s Gaurav Aggarwal believes that this is an even bigger moment than the telecom revolution. The Chief AI Scientist at Reliance Jio told Inc42 on the sidelines of the GenAI Summit that building foundational models are one part of growing India’s deeptech fortunes. “The other hurdle is that India being India, we have to build these models in an affordable manner, because otherwise it will only increase the divide between the haves and the have-nots,” Aggarwal added.

Like Soni and Sarvam AI’s Raghavan, he also believes that sovereign can mean many things.

His idea for sovereign AI: “In this global world, no one country can do everything. But as long as we have something that the world looks up to. And we are a critical part of the global value chain in AI or other things to come. There’s also a sovereign need in terms of defence and other things, but that’s a different need, and also critical,” Aggarwal told Inc42.

But the time to invest in the upstream is now; we missed the first bus perhaps a decade ago, and rarely do we get a second chance like this. Enough with the blame game; India needs collective action now to solve the deeptech puzzle and forge its future, or risk getting buried by global tides.

The post appeared first on .

You may also like

Stained socks, towels and bedding will turn 'whiter and cleaner' if you use 1 natural item

Rachel Reeves warns UK won't accept US trade deal if red lines are crossed

Outlander fans spot major 'plot hole' in Claire Fraser's multiple marriages

Man Utd's back-up transfer plan emerges as Ruben Amorim waits on £100m deal

Donald Trump threatens to withdraw US from Ukraine peace talks if deal proves difficult