India recently witnessed two mega-events: TheMahakumbh and the inauguration of theRam Temple. But these were not just great moments etched in the county’s spiritual legacy. They also paved the path for a new category of startups operating at the intersection of faith, communities and technology.

Often clubbed under the terms faithtech, spiritual tech, or devotion tech, these ventures arereimagining traditional religious experiences through digital platforms. What was once limited to temple visits and in-person rituals is now increasingly accessible online, thanks to a new wave of apps and services designed to meet the evolving habits of a digitally connected population.

Startups such as the Vama App, AppsForBharat, Astrotalk, DevDham, Utsav App and Japam have introduced offerings like virtual darshans, live-streamed pujas, astrology consultations and doorstep prasad delivery. As the digital infrastructure expands and smartphones go deeper into semi-urban and rural India, traditional religious experiences are rapidly going online, powered by the convenience and scale of communication technologies.

Industry numbers also support these growth trends. India’s religious and spiritual market is expected to reach $151.9 Bn by 2034 at a CAGR of 10% from $58.6 Bn in 2024. Also, more than900 startups are operating in this space, underscoring a thriving market. Therefore, investors are not far behind.

Consider this. In 2024, Bengaluru-based AppsForBharat raised $18 Mn in a Series B round, underscoring investor confidence in a category that is still evolving. Earlier that year, Noida-based DevDham also secured INR 6 Cr in seed funding, signalling a growing interest in the country’s spiritual practices.

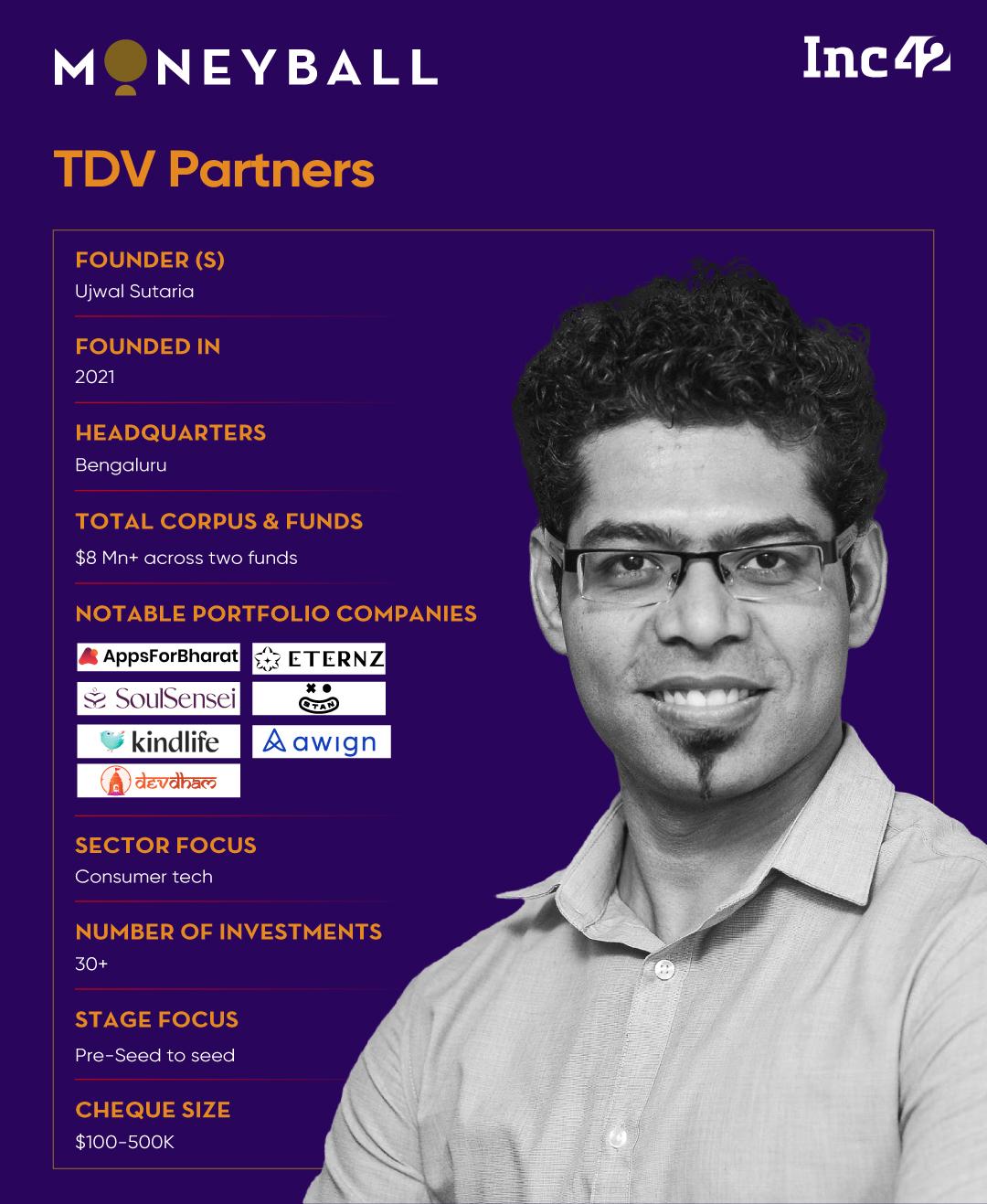

Among the early backers of these startups was Trillion Dollar Venture Partners, a young micro VC player that places early bets on what it sees as an untapped frontier.

“I am a big believer in the [spiritual tech] segment,” Ujwal Sutaria, founder and general partner at TDV, told Inc42 in an exclusive interaction as part of our Moneyball series.

“This is a unique opportunity for India. Faith is increasingly converging with the broader lifestyle, much like wellness. At TDV, we are investing in this space because it is a non-consensus bet in a deeply cultural category.”

According to him, faithtech, as a non-consensus play, has the potential to build strong emotional moats and drive habitual engagement. “It is a fragmented but massive economy worth INR 4 Lakh Cr+ with no definitive digital category leaders. That presents a compelling whitespace for innovation and scale,” he added.

Sutaria, a two-time entrepreneur and former investor at InnoVen Capital, backed a wide range of high-growth Indian startups such as Swiggy, Licious, Epigamia, BlackBuck, Eruditus and Dealshare. During his tenure at InnoVen, a leading venture debt firm, he played a key role in financing some of the country’s most prominent early stage startups.

He left the firm in 2021 to launch TDV, a micro VC initiative focussing on pre-seed and seed investments. The founder operated as the solo general partner and raised $3 Mn (approx. INR 25 Cr) for the first fund, writing cheques worth $100K to 30 startups.

Among its early bets were three faithtech startups — AppsForBharat, DevDham and Soulsensei. Interestingly, the Fund I is trending around 80% MOIC.

Fund II, with a corpus of $5.7 Mn (INR 50 Cr), was rolled out in 2024. The plan is to invest in 20-25 startups, with cheque size up to $500K in the next two years, and four investments have already been made from the second vehicle.

“Our mission is to support bold, visionary founders from the very beginning, entrepreneurs with the ambition to build category-defining companies that can drive transformative changes,” said Sutaria. “Even our name reflects that purpose — a commitment to backing those who aim to change the world.”

The broader portfolio includes startups such as KindLife, Eternz, STAN, Awign, AppX and Hypergro. Seventeen of these portfolio companies have already secured follow-on rounds, the founder claims, a promising signal of early traction in a competitive landscape.

As Sutaria dived into TDV’s investment thesis, he highlighted the selection metrics that would ensure the quality of investments. “We have received more than 1K pitches since launching the new fund. I review every application, after which each pitch goes through a proprietary algorithmic evaluation designed to identify high-potential startups based on our investment thesis. We fund less than 1% of the startups that pitch to us. So, the bar is intentionally high,” he told Inc42.

Here are the edited excerpts from our conversation with Trillion Dollar Venture Partners.

Inc42: You have been a founder, an investor and a fund manager. What catalysed your shift from building startups to backing them?

Ujwal Sutaria: The pivot was gradual. After completing my B. Tech, I spent three years at a PSU called PowerGrid, which was a conventional start. But the real spark came during my MBA at IIM Ahmedabad [2013-2015]. It was a defining moment for India’s startup ecosystem. Flipkart, Ola and Paytm were rewriting the rules. TaxiForSure was around, too. The first wave of digitalisation was underway, and it caught my attention.

At IIM Ahmedabad, I launched my first venture, FruitOn, a cold-pressed juice delivery service, and ran it for nearly five months. After graduating, I started my second venture, Athletto, a marketplace for searching and booking all types of sports venues and fitness centres. We ran it for three years, trying to digitalise the country’s fragmented sports ecosystem. On the supply side, Athletto provided a SaaS tool to help venue partners manage their inventory and marketing needs.

Throughout that journey during 2016-17, I pitched to more than 200 investors in India, the US and the EU. We didn’t raise much, but I enjoyed engaging with VCs to understand how they think and act.

I soon realised that if I wasn’t destined to be a founder, I still wanted a front-row seat in the startup world. And venture investing felt like a natural evolution to stay embedded in the ecosystem.

Inc42: What about the years at InnoVen Capital? What did it teach you about scaling companies and growing beyond your comfort zone?

Ujwal Sutaria: InnoVen was an inflexion point. That’s when I transitioned from founder to investor and joined the venture debt firm. I spent more than three years there, working closely with breakout consumer-tech startups.

My first deal there was Licious. I saw it grow from early traction to a unicorn. We backed Eruditus during Series A, and years later, it became one of the leading edtech players. I also managed Treebo Hotels, Nestaway, AgroStar and other businesses.

A couple of startups with whom I worked went public after I left InnoVen. But what stayed with me was a pattern of achievements. Great companies scale through relentless focus, not just massive funding.

I was an investor watching that arc — from Series A to scale to exit — and it taught me how to identify signals early, support founders without crowding them and build conviction. It was a great learning experience.

Building companies from 0 to 1 and working with startups as they scaled from 1 to 1,000 gave me the confidence to start something of my own.

Inc42: Raising a debut fund is difficult. What did that journey look like?

Ujwal Sutaria: It is always tricky, especially without a track record. I pitched to more than 100 limited partners [LPs] before I could secure the initial commitments. I am grateful to everyone who backed me in those early days and those who continue to support our current fund.

My background as a startup founder also played a critical role. I had navigated the journey from 0 to 1 while building my businesses. It gave me a first-hand understanding of starting from scratch.

Later, at InnoVen Capital, I had the opportunity to work with startups as they scaled from Series A to unicorns with billion-dollar valuations. Some of them eventually went public. Being close to those growth stories, even in a limited capacity, gave me deep operational and strategic insights. It came in handy when I raised my venture funds.

That dual perspective — building from 0 to 1 as a founder and watching the journey of 1 to 1,000 as an investor — became a key differentiator. Not many fund managers have that kind of exposure. It helps me connect more effectively with founders on the ground and enables me to bring a disciplined investor’s lens to decision-making.

For LPs, that duality is compelling. They know that I understand both the grind of building and the disciplined, long game of returns. It has helped me win competitive deals and build meaningful, enduring relationships across the ecosystem.

Inc42: How do you plan to do things differently in the venture capital space?

Ujwal Sutaria: About 80% of the companies we invest in are at the idea or paper stage. There’s no product, no revenue, and at times, not even a full team — just a solo founder. It shows how early we arrive, as we believe that maximum value is created from the start.

Again, our core focus is consumer tech. Many VCs invest in that segment, especially in direct-to-consumer [D2C] businesses and other brands, but these are just part of a bigger portfolio. For us, consumer tech is the thesis, and we back it from the pre-seed stage with long-term intent.

In fact, very few early stage VCs actively pursue consumer tech because it is capital-intensive and tends to involve large, ambitious bets — moonshot ideas targeting markets that are yet to boom. Creating such markets requires capital, which is why large players like Sequoia, Accel, Nexus, Lightspeed and Matrix usually lead in this space.

Most micro VCs don’t participate in consumer tech at an early stage, but we lean in, backing models like [ecommerce] marketplaces, exchanges and platforms where network effects can compound. We also focus on founders with prior startup experience or those with deep domain knowledge, trying to solve specific problems.

Interestingly, early stage investing is not always about tough competition for the best bet available. A lot of co-operation is there, and co-investments occur. We usually participate in the first round, varying between $500K and $1 Mn. In these cases, founders typically dilute their stake by 20% or less at a valuation of $5 Mn or lower.

TDV invests $100-500K, often alongside one or two micro VCs with similar or smaller allocations. This is how most of these early rounds get stitched together.

Inc42: You have said TDV’s primary focus is consumer tech. Could you tell us more about your core focus areas and target sectors?

Ujwal Sutaria: We invest in consumer-facing businesses, with a focus on three distinct areas — consumer tech, consumer upgrade and consumer AI. Within these categories, we primarily target scalable business models such as marketplaces, exchanges and platform plays. These can cover a variety of sectors, including fintech, spiritual tech, the gaming creator economy and social platforms.

Around 80% of our capital is invested in these core areas. The rest is reserved for exceptional founders and innovative ventures that fall outside these domains. They should be considered, as the quality of the founding team matters a lot at the pre-seed stage. Their vision and expertise can drive early success.

Meanwhile, our latest fund has included consumer upgrade as a focus area. This covers consumer products, services and lifestyle businesses catering to the top 100 Mn Indians, people with substantial disposable incomes and a willingness to enhance their daily lives.

These ventures may not always capture billion-dollar market opportunities, but many of them are likely to see outcomes in the range of $100-200 Mn. This is acceptable, provided they can scale efficiently and meet a clearly defined market requirement.

Let me give you a couple of use cases. One of our portfolio companies, Sports For Life, is developing a branded network of sports academies for youngsters. If you look around, you will find very few organised players offering structured training for soccer, cricket, tennis, or basketball. This startup is striving to fill that gap with a youth-focussed sports coaching chain akin to what CultFit has achieved in the fitness space.

Another is a clean energy startup specialising in solar power. It targets individual households and provides small-scale cleantech applications to improve the quality of life. These are precisely the types of businesses we are backing under the consumer upgrade theme.

Inc42: What about consumer AI? What is your investment thesis in that space?

Ujwal Sutaria: Even in the early stage, artificial intelligence is redefining consumer technology in three fundamental ways, both in India and globally.

First, it is transforming core user experiences by changing the way people engage with products. Second, it is personalising each user journey in real time by tailoring it dynamically. Third, AI is increasingly becoming the interface itself, whether through chat, voice, augmented reality, or other interactive formats.

For founders today, this represents a critical shift, as they must adopt an AI-first approach from the outset. The core problems getting solved across sectors like fintech, gaming, or spiritual tech may not change much.

However, the way these problems are now approached and the kind of user experience and user interaction that occur are all evolving from the ground up due to the advent of AI.

It means every consumer-facing application is now a candidate for reinvention. This presents a window of opportunity for startups that can move fast, build with an AI-native approach and deliver frictionless, hyper-personalised experiences.

Inc42: Why do you think India’s spiritual economy will power the next startup wave?

Ujwal Sutaria: Well, India is experiencing a transformation led by individuals rather than traditional institutions. Millennials and Gen Z, the country’s digital-first generation, are rethinking faith and spirituality. They are not rejecting faith; they are rejecting the friction surrounding these concepts. For them, spirituality is no longer confined to temple visits or rituals. It’s all about personal connections, accessibility and modern-day relevance.

As more people move online, offline to-dos like pujas, astrology consultations, temple donations or pilgrimage planning are also shifting to digital platforms. Covid-19 catalysed this shift, which saw temples livestreaming aartis, enthusiasts joining virtual satsangs and urban professionals attending Zoom sessions on the Bhagavad Gita. Today, homemakers from tier II cities order puja kits on WhatsApp and NRIs book pujas for remote services.

At the same time, global demand for India’s soft power — yoga, ayurveda, astrology and more — is witnessing a surge. But the user experience has not evolved in sync. With India’s digital rails, vernacular tech infrastructure and AI tools now in place, the timing is right to capitalise on this opportunity.

For a country of 1.4 Bn seeking spiritually rooted, digital-first experiences, this is not a niche. Indian startups are uniquely positioned to thrive on this shift.

Inc42: What are the key challenges faced by spiritual tech startups? How can AI address them?

Ujwal Sutaria: Spiritual tech has its own set of hurdles, and the biggest one is generating trust. People are naturally wary of the platforms that seem to commercialise faith. So, founders in this space need more than just coding skills. They must be culturally grounded.

Then, there is the issue of supply-side fragmentation. Rituals, priests and their practices vary across regions, making it challenging to standardise the experience.

Another challenge is user design, which combines UI and UX. You have to build something that works for a 25-year-old in Bengaluru and a 65-year-old in Varanasi. That is a wide spectrum in terms of inclusivity, behavioural patterns and digital comfort.

Finally, monetising these products requires sensitivity. Startups have to figure out how to generate revenue without making it feel like they are selling religion.

Artificial intelligence can address these gaps by creating contextual, personalised user experiences. For example, ‘AI companions’ can deliver daily affirmations or chants based on a user’s mood or intention. For older users, vernacular voice support can make these platforms easily accessible.

AI tools can also recommend rituals based on someone’s local traditions, festivals or personal horoscope. This can help curate and validate content, which improves authenticity.

At TDV, we are not looking to back Silicon Valley clones. We want to support founders who understand the spiritual and cultural heritage of places like Varanasi, as well as they know coding.

The world is already turning to India for spiritual learning, seeking peace at Rishikesh retreats or perusing mindfulness apps based on the lessons from the Bhagavad Gita.

We believe this is a moment where India’s cultural and spiritual knowledge can power the next wave of global consumer tech. And the next breakout company in this space could emerge from the intersection of tradition and technology.

Inc42: Are there sectors that you intentionally avoid? If so, why?

Ujwal Sutaria: There are three sectors I would typically avoid. These are agritech, healthtech and logistics. These industries don’t align with my current investment thesis. So, I generally stay away from them.

That said, I have recently observed specific shifts in the healthtech sector. Many companies are now building clinic chains for skincare, dental care, IVF [In Vitro Fertilisation] and related services. New technologies, including egg freezing and advanced fertility treatments, are also coming up. Hence, I am reconsidering my stand. But historically speaking, it has always been challenging to scale in that space.

Despite the growing opportunities, healthtech remains a capital-heavy sector with long growth and maturity timelines. It doesn’t mesh well with early stage venture capital, which thrives on quick returns. Healthtech businesses are more in line with private equity or long-term capital models, which have the investment horizon and risk appetite to match the sector’s slower pace of development.

Inc42: Finally, what’s your advice for first-time startup founders?

Ujwal Sutaria: At TDV, we invest in founders who can relate to the pain points they are solving and have strong, authentic reasons for building their businesses. We seek individuals who are resourceful with capital, focus on unit economics, and understand the challenges of operating in Tier II and III cities in India.

We value founders who communicate their vision, engage meaningfully with users and establish trust over time. We are particularly drawn to those who think independently and are willing to explore unconventional sectors like faithtech, vernacular-first products, or infrastructure-layer businesses that provide foundational hardware, software, or services.

We also focus on speed. We back people who launch early, iterate quickly as needed, and don’t wait for perfect conditions to take effect.

My advice to new founders is simple: Start with the first principles. Challenge assumptions; dive deep into the core of the problem and strip it down before building a solution. Quickly launch a minimum viable product; get it tested by real users and refine it based on their feedback.

Additionally, take the time to understand the problem thoroughly. Founders who are close to users or have personally experienced the pain points tend to build better solutions.

Think big, but stay flexible. Building global businesses or category-defining companies is good. But there is also value in creating capital-efficient firms with strong fundamentals. An outcome of INR 500–800 Cr can still deliver meaningful success. Not every company needs to reach unicorn status to create a lasting impact.

[Edited by Sanghamitra Mandal]

The post Decoding TDV Partners’ Investment Playbook For India’s Booming Spiritual Tech Market appeared first on Inc42 Media.

You may also like

'They have a choice..': Usha Vance on what religion their children follow; 'Hindu rituals part of their life'

Pastor's daughter, 3, dies in hot car after he forgot to drop her at nursery

Esther Rantzen's daughter appalled by sickening fake photos claiming to show star in coma

Lions handed major boost as Andy Farrell drops injury update on stars

How to watch Juventus vs Man City for FREE with Club World Cup clash not on UK TV